Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 1 October 2019 00:15 - - {{hitsCtrl.values.hits}}

Investors Panel Discussion on the challenges and opportunities in investing in the dairy sector

Financiers Panel Discussion on the challenges and opportunities in lending to the dairy sector

Market-Oriented Dairy (MOD) last week launched the Dairy Investment Fund at the Market-Oriented Dairy Investment Forum in the presence of industry leaders of the dairy value chain.

The Forum also offered an opportunity for the business and finance stakeholders in the industry to discuss investment opportunities and constraints.

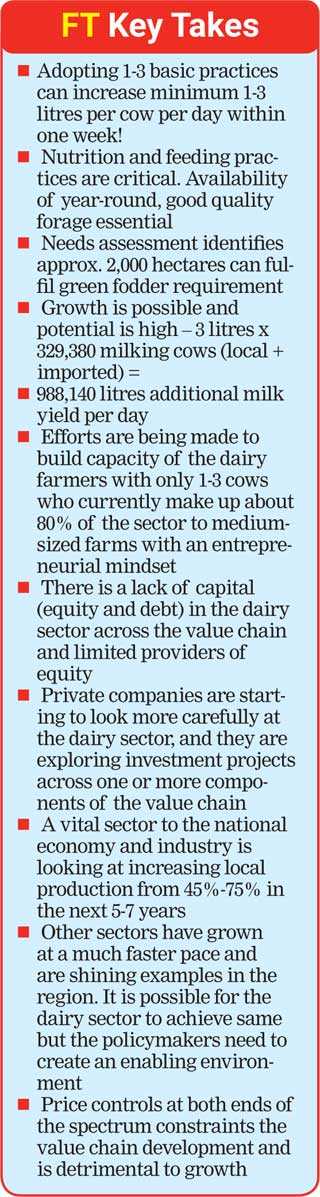

Commenting on the rationale for setting up such a fund, MOD Project Director Matthew Krause said, “While the Project’s primary focus is on building capacity holistically across the dairy value chain, it was evident that lack of capital (debt or equity) is a constraint. We have several avenues for facilitating financing for the smaller farms, input retailers, fodder cultivators and silage makers through the traditional banking system, but this Fund was set up purposefully for projects exceeding Rs. 87.5 million or $ 500,000.”

Launching the Fund, SEAF Senior Managing Director David Mathewson said: “Typically we manage growth capital and provide business assistance to small and medium enterprises (SMEs) in emerging and transition markets underserved by traditional sources of capital. Our goal is to invest in entrepreneurs who seek to build successful businesses, hoping to realise both attractive returns for our investors and a measurable development impact in local communities.”

SEAF’s services go beyond capital, with the organisation providing support through the growth phases, strategic and operational support, scale-up support, networking support, long-term vision formulation and process management.

The fund will provide debt or equity financing to targeted dairy investments for the development of priority sub-sectors within the dairy value chain such as inputs providers, breeders, large farms, dairy cooperatives, collectors, chilling centres, processors and retailers.

Earlier this month, expressions of interest were called for expansion projects or new initiatives sponsored by existing business ventures. Over fifty applications have been received and a number of applicants shortlisted for further review and assessment, and discussions are ongoing with the fund managers.

At the Investment Forum, a presentation by All Island Dairy Association (AIDA) President Nishantha Jayasooriya focused on creating awareness of the dairy sector and opportunities on both the demand side and the supply side in a market growing 13% year over year.

Matthew Krause presented on the gains made by implementing dairy farming best practices upstream and Department of Development Finance Enterprise Sri Lanka Director General Rizna Anees and Small Agribusiness Partnerships Program (SAPP) Project Director Dr. Yasantha Mapatuna presented on the progress and the future of available lending schemes to the dairy sector. Two vibrant panel discussions, facilitated by Maliban Management Consultant Asoka Bandara had the panellists deliberating on challenges in lending to the dairy sector and challenges in investing in the dairy sector. The financiers’ panel consisted of HNB DGM SME and Mid-Market Jude Fernando, DFCC Senior VP MSME Chandana Wanigasena, HDFC Head of Development

Credit Anura Dissanayake and Commercial Bank Head of Development Banking Malika De Silva.

The investor panel was represented by Richlife Dairies CEO Nishantha Jayasooriya, Nestlé Lanka Vice President Bandula Egodage, Lanka Milk Foods Director Dr. A. Shakithevale, Prima

Group General Manager S. Tan, and Sunshine Holdings GM Business Development Aroshan Serasinhe.

Market-Oriented Dairy (MOD) Project (www.market-oriented-dairy.org), based in Sri Lanka, is funded by the USDA Food for Progress Program (www.fas.usda.gov/programs/food-progress), and implemented by IESC (www.iesc.org). The project aims to double the milk production of participating dairy farmers and enable them to obtain a higher price premium for fresh milk through interventions primarily designed to enhance their technical knowledge and create an entrepreneurial, business-oriented mindset.

The project also supports enterprises along the dairy value chain to meet the demands of the country’s dairy sector to catalyse a sustainable growth. The project’s sub-partners are Sarvodaya, University of Florida, Global Dairy Platform and SEAF.

SEAF is a global impact private equity manager achieving meaningful and measurable impact results and positive financial returns by providing entrepreneurs in emerging markets with the capital, knowledge, and networks they need to grow their business. Since 1989, SEAF has invested in more than 380 companies in 27 countries.