Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 8 April 2019 00:00 - - {{hitsCtrl.values.hits}}

The Tea Exporters Association (TEA) organised a seminar on the theme of ‘Challenging Times for Ceylon Tea’ last week at the auditorium of Ceylon Chamber of Commerce. The event was attended by Members of Parliament, senior officials of Ministry of Plantation Industries, Sri Lanka Tea Board, Export Development Board, Tea Research Institute, Registrar of Pesticide, National Intellectual Property Office, Central Bank, Ministry of Foreign Affairs, Department of Commerce and tea industry stakeholders representing growers, producers, manufacturers, brokers and exporters. The presentations were delivered by senior trade members with over 30 years’ experience in the tea export sector.

Explaining the objectives of the seminar TEA Chairman Jayantha Karunaratne stated that when tea industry issues are discussed most people talk about problems faced by the producers or manufacturers only and do not pay much attention to issues encountered by tea exporters while marketing tea to international buyers. Hence the seminar was planned to educate both the policy makers and stakeholders on the challenges faced by tea exporters either due to internal factors or external factors when marketing Ceylon Tea. The exporters have to evaluate about 12,000 tea samples a week and then purchase tea at the auction, make the full payment to producers in seven days as per the by-laws and then process tea, pack and ship to the foreign buyers.

In most cases the payment is received between 30-120 days and in some worst cases after about six months. Despite the long wait the exporters are expected to operate at the weekly tea auction in the same manner to ensure better prices for the producers. If credit is not given to the buyers it will be difficult to compete with other tea producing countries. Almost all exporters depend on bank credit that comes at a price to finance their operation in the interim period.

The most concerning factor for the tea exporters is non-availability of consistent policies whether it is monitory, fiscal or regulatory. The other domestic issue is tea producers not responding to international requirements in a timely manner, he further stated. This lack of consistence in policy matters affects the competitiveness of Ceylon Tea in the global market.

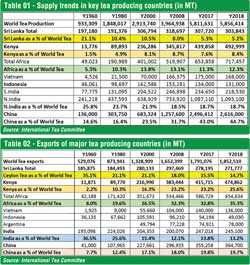

The presentations began highlighting the opportunities available in the world tea market. The global tea consumption has grown over the last ten years from 3.9 billion kg to 5.2 billion kg by 2018. China and India have been the driving forces in the world tea scene as they have positively contributed towards the growth in production and consumption. Some policy makers and stakeholders believe that the Sri Lankan tea industry is doing well, Ceylon Tea is the best and it should fetch higher prices, but they are unaware of the fact that other tea producing countries have slowly entered in to the world orthodox black tea market that was previously dominated by Sri Lanka.

China was never considered a serious competitor to Ceylon Tea as their tea was subject to chemical tests in many tea importing countries. Today China has emerged as a strong contender in the black tea market as well and has overtaken Sri Lanka in the world tea exports in terms of volume and value. Kenya, predominantly a CTC tea producer, has increased her orthodox tea production from 1.5% of the total tea production in 1960 to 8.4% by 2018 and it will continue to grow. Kenya successfully challenges Sri Lanka’s position in Russia, Iran and some other traditional orthodox tea markets. The innovation in tea production is the key to success of Chinese and Kenyan tea exports while Sri Lanka is grappled with a number of issues due to low tea production.

As per International Tea Committee (ITC-UK), the world tea export volume has come down from 1.8 billion kg in 2014 to 1.7 billion kg by 2015 and remained at the same level till 2017 indicating a declining trend or stagnation in the world tea export market. However it went back to 1.8 billion kg last year. The challenge for Sri Lanka is to increase her share in a market which is not significantly growing in terms of volume. The diminishing share of Ceylon Tea in world tea production and exports reduces Sri Lanka’s ability to influence the global tea market. Under the scenario Sri Lanka has to offer a better product to retain her international clients and gain a fair share in the global tea export trade with enhanced prices.

Explaining the Sri Lanka tea industry position in relation to world tea market, it was noted that Sri Lanka’s share in the world tea production has come down from 21% in 1960 to 10.5% in 2000 and then to 5.2% by 2018. Similarly Sri Lanka’s share in the world tea export market too have declined from 21% in 2000 to 14.7% by 2018. The Unique Selling Proposition (USP) of Ceylon Tea – its taste and character too have diminished over the years with producers shifting from ‘Bud and Two Leaves’ plucking norm due to decline in tea crop since 2013.

Sri Lanka needs to focus on taste and quality of Ceylon Tea as it was known for such characters before to regain her position in the world tea market. The use of substandard raw material will not help to produce better quality tea. The need of the hour is diversification of the product portfolio and re-positioning of Ceylon Tea as a premium product. The replanting of tea will naturally increase the tea production volume and may bring down cost of production, but in a declining world tea export market enhancing volumes will not bring the desired results to increase foreign exchange earnings. The Sri Lanka tea industry may learn a lesson from the experience of Sri Lanka Gem and Jewellery Association who was able to elevate the Sri Lanka Sapphire to a great height in 2011 by re-positioning the product. When Prince William presented a ring with Ceylon Sapphire, that was previously used by Princess Diana, to Kate Middleton during the Royal Wedding, they saw an opportunity to promote it as an exclusive product used by the British Royal Family. The Association conducted a well-structured media campaign in UK, Russia and China that saw an increase of export of Ceylon Sapphire by 37% in the following year. Sri Lanka tea industry needs to engage with international consumers to enhance value profile of Ceylon Tea.

Approximately 51% of Ceylon Teas is exported to five countries – Iraq, Russia, Iran, Turkey and Libya. They are the heart of Sri Lanka tea exports. However the five countries are volatile markets as they are frequently affected by political uncertainty, subject to international sanctions, slow or negative economic growth, currency fluctuations, high inflations, etc. that affect their purchasing power. The high tariff in Turkey, Russia and Iran also affect negatively on Sri Lanka tea exports especially on value added tea exports.

The somewhat over reliance on these five volatile markets has a significant impact on the auction price. A disruption in one market could have serious ramifications on the Colombo tea auction prices.

The weaponisation of finance by USA has affected some of these markets badly. During the last 3-4 years the Russian Ruble has depreciated by 99%, Iran Riyal by 251%, Turkish Lira by 153%, Libyan Pound by 13% and also the Syrian Pound by 500%. The depreciation of currencies in tea importing countries negated the benefits that may have accrued to the Sri Lanka tea producers when the local currency was depreciated by 23% during the last two years. Further the top five buyers of Ceylon Tea depend heavily on the oil income and the downward trend of oil prices that has been witnessed during the last five years has reduced the buying power of the buyers and consumers in these markets.

Although the next biggest buyers of Ceylon Tea (from 6-15) are relatively stable Sri Lanka exports only 17% of the total volume to these markets. Since Sri Lanka tea share in USA and Pakistan, two largest teas importing countries in the world, is rather insignificant, the country should concentrate on other markets that have potential for expansion. If Sri Lanka can increase her market share by about 5% in other markets it will have a substantial positive impact on the price of Ceylon Tea at the auction.

The absence of Geographical Indication (GI) protection for Ceylon Tea in the world market is another concerning factor for the Sri Lankan brand exporters. Although an amendment to 2003 Sri Lanka Intellectual Property Act was approved in 2014 to incorporate GI protection for Ceylon Tea, Ceylon Cinnamon, etc. the legislation for registration locally is yet to be implemented. The non-availability of an effective protection for Ceylon Tea leads to massive counterfeits of Sri Lankan tea brands by some foreign trade members but local exporters have very little legal resources to stop it. This undercuts the efforts of pure Ceylon Tea brands as the counterfeit brands offer cheap mixed origin teas as pure Ceylon Tea.

In the past, quality of Ceylon Tea evolved around three factors – appearance of made tea, its flavour and aroma and the liquor (brew). Today the tea quality profile has gone through a significant change and covers a wider area as foreign buyers demand ‘Holistic Quality of Tea’. The introduction of standards such as ISO 3720 minimum standard for black tea, compliance with MRL in tea when it’s come to use of pesticide and weedicide and the demand for a guaranteed product throughout the supply chain are some of the new quality parameters demand by the international buyers.

Sri Lanka has 712 tea manufacturing factories for production of about 300-320 million kg of tea compared to 110 factories in Kenya which producers about 500 million kg of tea annually. The decline in tea crop and availability of the large number of tea factories more than the required numbers have led to an unhealthy competition for raw material that affects the quality of final product. Most factories are unable to operate in full capacity that leads to high cost of production. The stiff competition for green leaves has shifted the plucking norms from bud and two leaves and the end result being decline in quality of tea that exporters find to market among the foreign buyers.

The deterioration of discipline in the field and factory has led to decline in Ceylon Tea characters that was famous among the world tea consumers. Some foreign buyers are already complaining that Sri Lankan tea has lost its characters compared to what it was 10-15 years ago.

Despite being a signatory to FAO/IGG agreement to adhere to ISO 3720 minimum standard for black tea that prescribes that tea should be free from any extraneous matters, some tea producers pay very little attention to this minimum requirement creating enormous problems for the exporters. The tea exporters have been compelled to invest heavily in cleaning machinery at a significant cost to clean the tea that comes with a lot of foreign matters. The traceability concept that first emerged in European markets is now being followed by many tea importing countries. The foreign buyers request for total quality from growers up to the point of exports.

Therefore, all in the tea value chain has a responsibility to offer a quality product that will eventually help to retain the customers and also to get better prices. Today most of the large foreign tea companies pay less attention to the origin of tea but expect the producers to comply with accepted quality standards.

The ban on glyphosate for about three years had an adverse impact on Ceylon Tea as the producers were not left with any alternate product. Some producers resorted to using non approved chemicals to address the weedicide and pesticide issues. The authorities opened their eyes only when Japan suspended Ceylon Tea imports due to excessive limits of MRLs. Though the situation has changed now the exporters suffered due to rejection of shipments, high cost of testing of samples before the shipments etc. The producers too suffered to some extent with high grown tea prices coming down due to reduced demand from Japan. The foreign buyers now look in to what is inside the cup as well as what is outside the cup. This scenario has happened as tea is now considered a food product and is subject to a number of food safety regulations in the importing countries.

Tea producers have a huge responsibility to supply a good quality product. The existing regulations should be strictly followed and implemented to guarantee a safe product. The foreign buyers should have confidence in Ceylon Tea to ensure continued purchase. The manufacture’s should have consistency in product quality and minimise their waste and defects. The Japanese buyers have stated that, they are prepared to buy more tea from Sri Lanka and pay better prices also provided that producers give them a quality product.

The sustainability of the Sri Lanka tea industry is threatened by high cost of production that goes up YOY. The labour issue especially in the plantation sector stresses the need for mechanisation in tea production where ever possible. The plantation workers are leaving the tea industry to other sectors for economic and other reasons. The producers do not retain sufficient funds for re-planting and other development. The producers are doing the same thing that they have been doing 50 years ago expecting different results. Since Sri Lanka is now classified as a middle income country the demand for higher wages and elevation of status will continue. The end result is increasing cost of production that does not relate to product quality on many occasions. In Sri Lanka the agriculture sector is lagging behind compared to the performance of industry and service sectors. Perhaps a solution to the tea sector is to transform itself from being a primary agriculture producer to an industrial agriculture producer.

The cost of purchasing tea at the auction is also rising as exporters spend two full days at the auction to secure their requirements. After 150 years of its existence, Sri Lanka has failed to automate the tea auction process while India and Kenya are already having online tea auctions that reduce the cost of procurement of tea.

The heavy taxation of tea exports sector prevents tea companies from investing profits to develop the business. The increase in Economic Service Charge (ESC) from 0.25% to 0.50% in 2017 badly affected the cash flow position of tea exporters. Those who want to promote exports always advise that exporters should not be subject to heavy taxes but the government continues to have taxes on the tea export sector. The recommendation to reduce the ESC rate from 0.50% to 0.25% from 1st June 2019 would be good news for the tea exporters. However, the cess payments on export of tea in bulk and packet forms and the tea promotion levy will continue to affect the performance of tea exporters.

The Tea Exporters Association requests the policy makers, relevant state organisations and tea producers and manufacture’s to understand the changing world situation and respond to it without delay in order to sustain the tea industry. Ceylon Tea is arguably the most well-known origin for premium black tea in the world but the younger consumers in tea importing countries no longer understand that Ceylon Tea is an indication of origin, i.e. that it comes from Sri Lanka. The authorities should expedite the legislation for GI registration in Sri Lanka to enable SLTB to protect the Ceylon Tea name internationally and also to focus on the link between Ceylon Tea and Sri Lanka in their global Ceylon Tea campaign.

The country has to redefine its position in the world hot beverage market. It may focus more on the specialty tea segment as the potential for Ceylon Tea in mass market is somewhat weak. The only way for Ceylon Tea to regain its position in the international tea market is to improve its quality profile in and outside the cup. Innovation in tea production and reposition of Ceylon Tea as a total quality product, etc. will finally get better prices by retaining the foreign consumers.